- A proposed Nebraska constitutional amendment would limit property tax increases to the Consumer Price Index inflation rate

BROADCAST TRANSCRIPT:

OMAHA, Neb. (KMTV) — A proposed constitutional amendment in Nebraska could significantly change how property taxes are calculated, limiting increases to match the federal inflation rate.

Under the proposal, property taxes could only increase by an "allowable growth percentage" tied to the Consumer Price Index, which measures inflation. The current CPI rate is 2.4%.

"This amendment would really, really help affordability, because it would make it easier and more affordable for younger singles and couples to buy homes," Douglas Kagan, president of Nebraska Taxpayers for Freedom, said.

If property taxes only increase by the inflation rate during ownership, taxes could jump drastically for new owners when the property changes hands.

"At the very least it disincentivizes them from, you know, moving into the, you know, the next house because their tax bill is going to go up," Jon Cooper, the executive director of the Nebraska Association of County Officials, said.

Under the current system, property tax increases can exceed the inflation rate, creating financial strain for some homeowners.

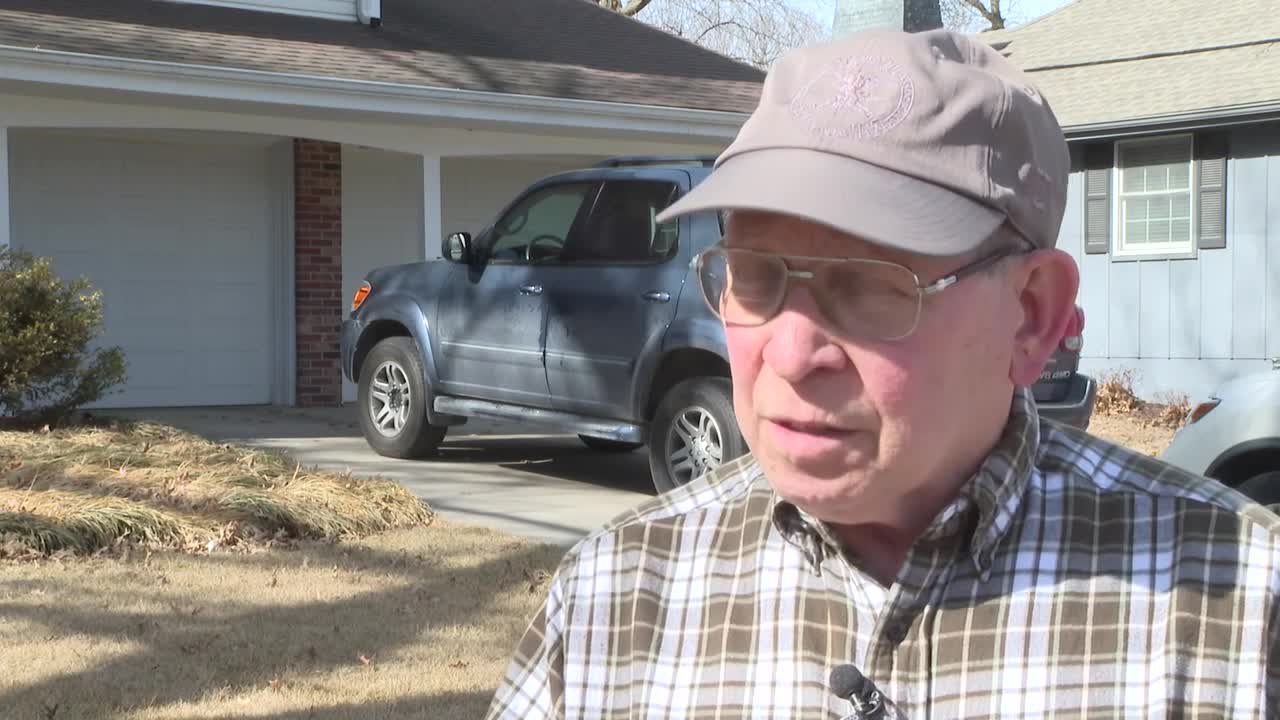

Alan Seybert, a longtime Omaha resident, has watched his neighborhood grow significantly since moving in.

"At the time we moved in here, the subdivision was the furthest northwest in Omaha. Not anymore," Seybert said.

He expressed concerns about the current property tax system.

"I am concerned that eventually we might get to a point where it's going to be causing more problems, if there isn't something that's done about the current process," Seybert said.

Before voters can decide on the issue, state legislators must first approve sending the constitutional amendment to Nebraskans for consideration.

"This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy."